- Activant's Greene Street Observer

- Posts

- Activant's Greene Street Observer No.8

Activant's Greene Street Observer No.8

On convexity, how to win in embedded finance, and the latest Activant news

On Convexity

Founders, Partners, and Friends,

For the most part, startups lose money, with exceptions – like Microsoft. What is critical is building a sustainable business model that can generate profits in the long run. It is stunning to me, over the last decade and a half, how much money has been made by firms investing in companies that have never turned a profit. There are numerous examples such as Uber, Square, Snowflake – the list goes on if we don’t exclude add-backs like stock-based compensation. There are even more on the private side, including Stripe, Chime, Databricks, and hundreds of other multi-billion dollar valued businesses that are unlikely to generate sizeable profits in the next few years.

Technology buyouts are not immune from this trend either. In general, they going to struggle to achieve profitability given the rate environment. According to Bain & Co., the average EBITDA multiple for global software buyouts from 2011 was below 10x. This skyrocketed in the following years, with the average purchase price for a software company in 2020 and 2021 above 20x EBITDA. Even worse, mega buyouts peaked at an average of 23x, with some deals like Cloudera, Ultimate Software, and others in the 30x range, and Proofpoint over 50x. Most of the success of buyouts in the last decade was based on multiple expansion in a low-rate environment, not organic growth.

With interest rates for buyouts up as much as 700-1,000 basis points, most of the free cash flow for a buyout is now required to cover interest expense. Forget about paying amortization.

There are companies, like Amazon, that operated unprofitably for over a decade before it turned a profit. We have to be careful pointing to such outliers as an example. Tech assets tend to be long duration, which means they are rate sensitive. The “Amazon” model in a rising rate environment becomes much more difficult to pull off. Amazon built its business as rates were dropping, but some of you may recall that it almost died. In February of 2000, the company sold a €600 million convertible bond to overseas investors. If they had waited even three weeks, the company would likely have ended up in the Pets.com graveyard as the Dot-com bubble burst.

Across three asset classes – venture, growth, and buyout – technology investors primarily relied on the greater fool theory. Companies got marked up, or were purchased at a higher multiple. These companies passed from one investor to another, and some eventually to the public markets – all while not generating profits (excluding add-backs).

By now we would have expected to see more rational behavior. Instead, we have been seeing the opposite. According to Crunchbase, valuations for Seed and Series A are up from 2021. In venture and growth land, we see many firms defending valuations in their portfolio companies, using preferred equity, structure, or notes. We call this “pretend and extend.” Lastly, buyout firms have been putting up capital to stay out of default, sometimes publicly, like in the case of Finastra.

In sum, we are concerned that there is an enormous amount of convexity in the technology market today. Particularly in the private market and for public companies with negative earnings. There is a lot more downside than upside.

What does this mean if you are running a company at any stage? Deliver value to your customers that allows for a sustainable business model with an eye toward understanding capital allocation.

Being overly optimistic about a product can cause poor capital allocation decisions. Even Steve Jobs misspent capital with the introduction of the “Lisa” and the original Mac, which may have cost him his job.

Misplaced optimism in the market can cause an even bigger misallocation of capital - so plan for a couple more difficult years and the market will reward your persistence and patience in the long run.

Let’s go! 🚀

Steve Sarracino

Founder & Partner

Our latest research report on Embedded Finance is out now!

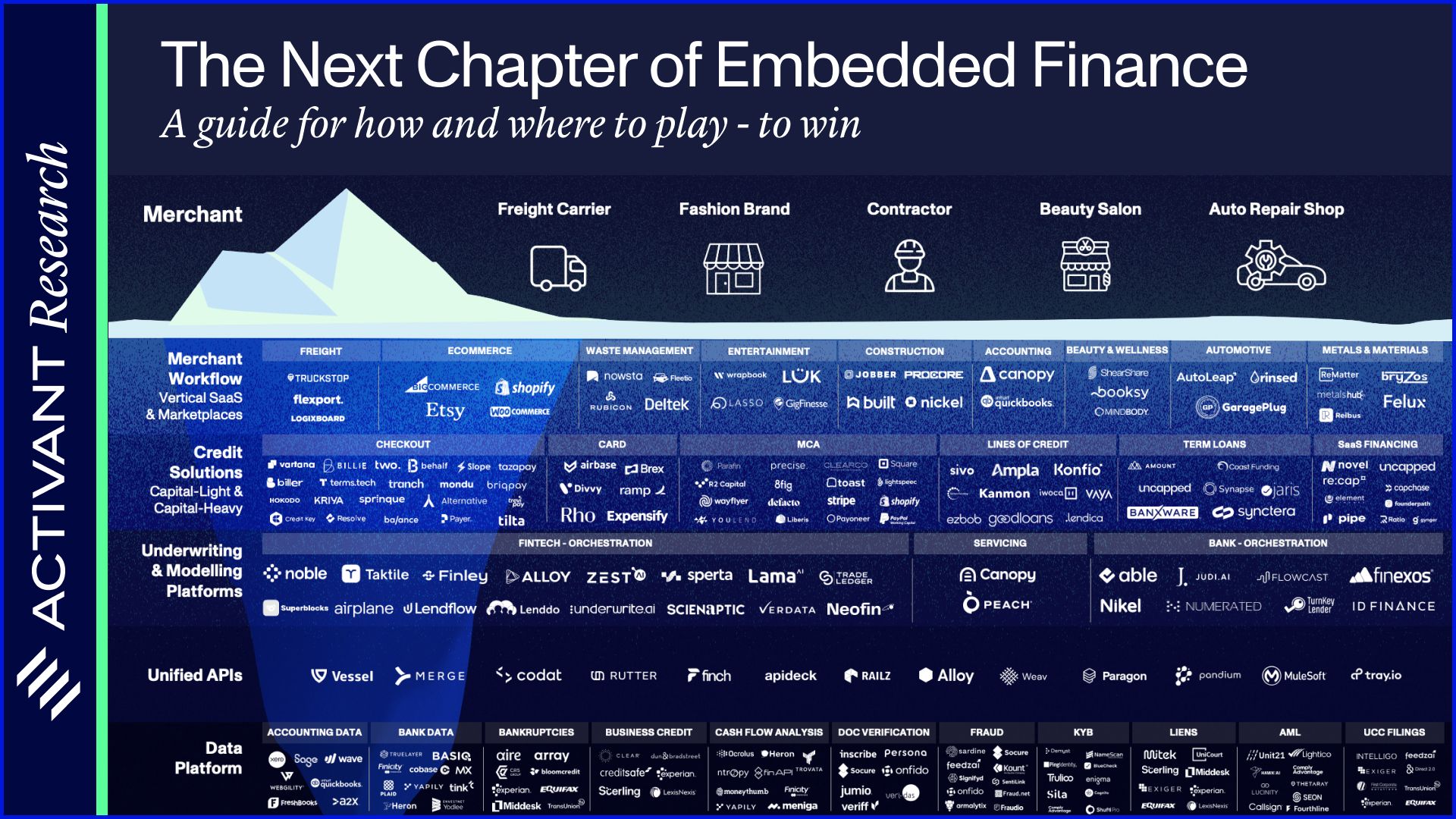

We see the embedded finance ecosystem like an iceberg - while a merchant has a positive experience with an embedded loan above the surface, the much deeper universe of companies below makes it all possible.

Become more “workflow” and less “finance” over time. Founders can solve pain points in B2B transactions by deeply integrating their platform to access and analyze customer data and increase wallet share (i.e. the visibility they have into a customer’s finances).

The goal of embedded finance is to build software. In the future, embedded finance will digitize trillions in transactions, and help B2B buyers determine early on if a product is right for them financially.

Read the full article below to find out how we think founders should tackle a multi-trillion-dollar opportunity.

We’ve received some great feedback on this report. If you’d like to chat further about our findings, reply to this email or reach out to the report authors JJ and Andrew.

Better debuted as a public company on the NASDAQ. [HousingWire]

Sardine, which focuses on anti-fraud tech for payments, was included on Forbes Next Billion Dollar Startups list of 2023. [Forbes]

Celonis appointed Carsten Thoma as President. Carsten was the founder of Hybris (acquired by SAP), one Activant’s first investments. [Celonis]

Checkout platform Bolt had its brand refresh covered in A Change of Brand Podcast. [A Change of Brand Podcast]

Don’t cry for me Argentina: We said goodbye to our hardworking summer interns as they headed back to school.

Bidenomics: Our Founder and Partner Steve Sarracino spoke with CNBC to give his perspective on President Biden’s latest executive order to limit tech investments in Chinese technology.

Meet me at the Crosby: Our Partner Andrew sat down with Fortune to give his thoughts on whether or not the Crosby Hotel is NYC’s latest VC hotspot.

Activant is a research-focused global investment firm that partners with high-growth companies transforming the way the world makes, moves, and sells.

Founded in 2015, Activant has invested in category-defining companies like Deliverr (acq. by Shopify), Hybris (acq. by SAP), Bolt, Better, Celonis, Sardine, and many more.

The firm has $1.5B assets under management and is headquartered in Greenwich, Connecticut, with offices in New York City, Berlin, and Cape Town.

The Greene Street Observer is published monthly from Activant’s office on Greene Street in New York City.