- Activant's Greene Street Observer

- Posts

- Activant's Greene Street Observer No.9

Activant's Greene Street Observer No.9

On building for the long-term, Bits & Pretzels celebrations, and upcoming events

On Building for the Long-Term

Founders, Partners, and Friends,

In late September, I had the pleasure of interviewing Alex Rinke, co-CEO of Activant portfolio company Celonis, at the Bits & Pretzels conference in Munich. For context, Celonis is the largest private software and AI business in Europe that you probably haven’t heard of - and Alex had some great practical advice for founders. For most of you this is just a friendly reminder:

Be customer obsessed. Listen to your customers and incorporate that feedback into your product.

Have an amazing demo. Your product and demo needs to be 10x better in this environment.

Hire with intention. The first 100 hires matter a lot.

Persevere. If you love what you do, you will make it through.

He had so many insights, and it was a reminder that the only thing constant is change. AI is going to simplify software again and give companies tools to manage and build their own internal systems in ways that were never possible before. For instance, we are looking at companies that are building proprietary AI for legacy industries, and rather than selling software, we are looking at going vertical - meaning acquiring assets and running them more efficiently. The possibilities for new and exciting business models are endless.

But the takeaways for founders go beyond the practical. As far as the Celonis story, they bootstrapped for about five years before they raised capital. In one year, Alex drove about 100,000 miles around Germany meeting with customers. In one case, they lost an RFP about a year and a half into their business and rather than ignoring the feedback, they rebuilt their entire product. This is sometimes more necessary in enterprise, as to build amazing software and tools, management teams must have specific knowledge about that industry.

Steve Jobs may have disagreed and we all are familiar with him saying the customer doesn’t know what they want. In reality it is a mix – who wouldn’t want a computer in their pocket? I think what Steve did wasn’t tell us what we want, he made the experience frictionless, I believe that was the magic. He understood human nature - that like water flowing downhill, humans in general will take the easiest path. Make it simple, and they will come. As far as bootstrapping, Apple started the same way - pre-selling computers to pay for inventory and salaries.

If you are a founder, bootstrapping is just one way to start a business, but the general sentiment today is to build being much more capital efficient. Why is there such a focus on capital efficiency? For one, it will create better DNA for your business. Constraints, in my opinion, breed creativity and focus, and allow management teams to prioritize.

The second reason we hear about capital efficiency is the market. With help from one of our advisors, we reviewed almost 4,000 venture and growth funds from 1978-2023 with a focus on looking at the dot-com bust. I lived through that period and distinctly recall the market recovering in 2004. Afterwards, the “great financial crisis” wasn’t even a blip in the technology market – in fact, it was an accelerant.

Even though my memory served me well from a public markets perspective, the private markets painted a VERY different story. From 1998 - 2008, the median fund had an IRR of less than 10%, or even negative. To put a point on this, for 11 years, the private technology market was nothing short of a disaster, on average. If you look at the top quartile funds, they didn’t break 15% IRR until 2008 and had five years in the single digits, 1999-2003. TVPI followed a very similar trend.

How does this apply to us today? As a management team, build a bomb-proof balance sheet. What I mean by that is manage cash to either get to break-even or give yourself the ability to run for perhaps four years or more!

Yes, that may mean you have to move slower, and in this market you have time. Customers will take longer to adopt and less competitors are getting funded in this environment. Slow is fast and fast is slow - take your time to build. And if you are a multi-time founder, you understand that is the biggest issue with Venture Capitalists – they almost universally forgot that patience is critical, and duration can be the most predictive creator of wealth (think Warren Buffet). These VC investors talk about speed, fail fast, iterate fast, find PMF fast, and offer dumb platitudes on Twitter and LinkedIn. At the first sign of trouble, they will bail on you.

In my interview, Alex used a quote from one of his mentors, “as a founder/CEO, you will be the first one to hold your company back, and the last one to notice.” Find an investor who can help you notice and is willing to be patient - but do them the favor of watching every penny!

Let’s go! 🚀

Steve Sarracino

Founder & Partner

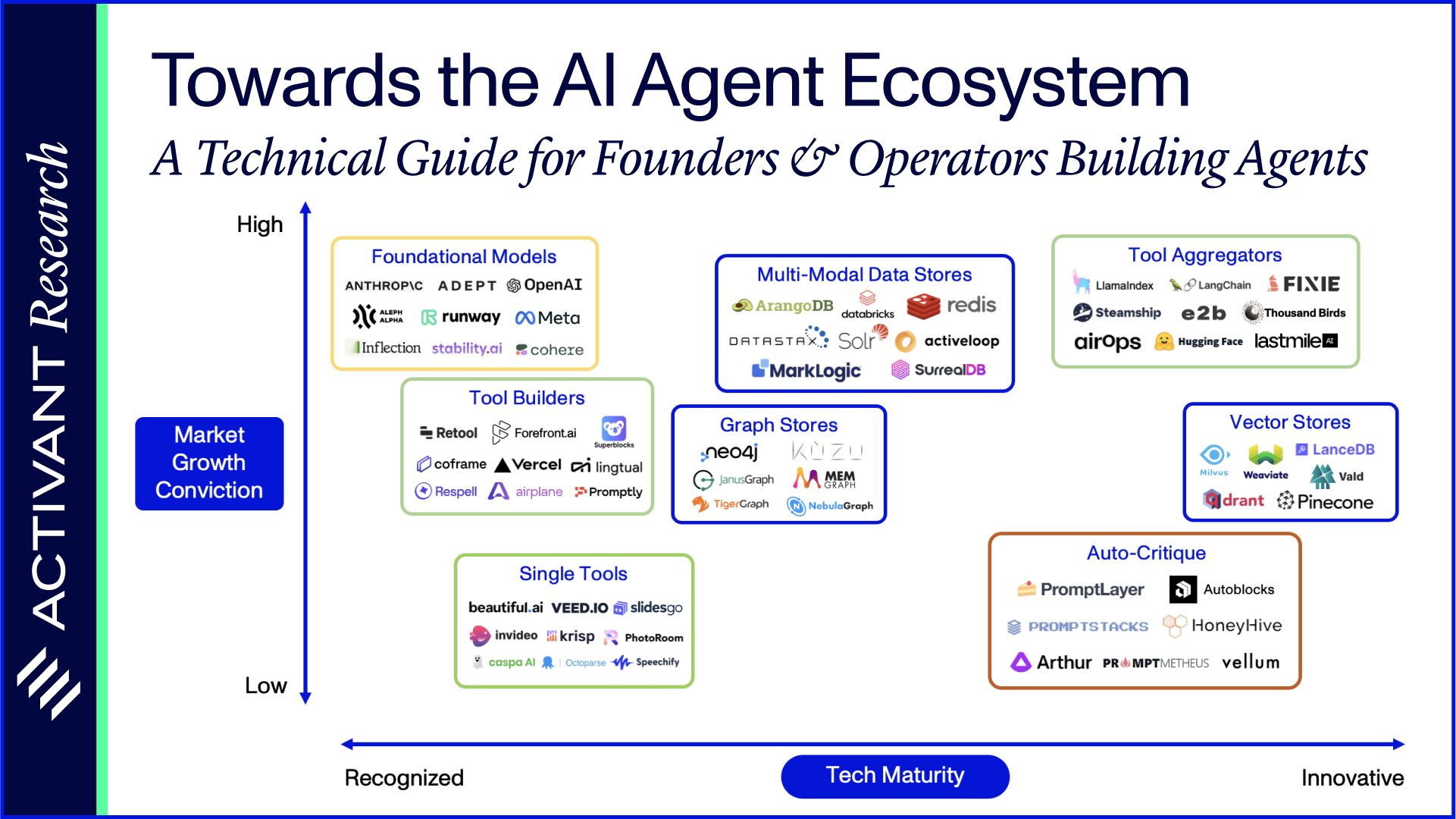

Our latest report digs into the world of AI Agents - it’s a technical guide for founders and operators building in AI.

The key takeaways?

While LLMs are powerful, they still can’t accomplish most tasks on their own. But that changes with AI Agents. By arming an LLM with various tools, memory, and self-critique abilities, an Agent is born.

And while one Agent is powerful, many Agents can form a Team that can work collaboratively to complete complex tasks.

We believe AI agents and Agent Teams will radically transform the information economy. And they might come dressed in black.

Read the full report at the link below - we cover nearly 100 of the companies in the ecosystem working to make AI Agents a reality.

We’ve received incredible feedback on this report from the community so far. If you’re building in the AI Agent space and want to talk to the report authors, reply to this email or reach out directly to Marc, Julius, and Andrew.

Prost! Last month, Activant went all-in for Bits & Prezels, a conference in Munich coinciding with Oktoberfest. We held a founders & investor meetup across from the iconic Munich Opera.

Thanks to the leaders from portfolio companies Workmotion, Vivenu, Vartana, and Celonis for joining us at Bits & Pretzels - and a special thanks for our German team Maximillian and Josh for producing such an incredible experience!

In NYC, we co-hosted a founders dinner with sales automation platform Chili Piper at Cecconi’s.

And coming up, we’re hosting a panel on LLMs for the Enterprise with Devvret Rishi, Co-Founder of Predibase and Josh Browder, Founder of DoNotPay - moderated by our partner Andrew. That’s in San Francisco on October 19th - get on the list here.

And for Money 20/20 in Las Vegas at the end of the month, we’re co-hosting a mixer for fintech founders and operators with our friends at Sardine: check out the details here.

Bolttech, an embedded insurtech platform, raised an additional $50M in Series B funding from LeapFrog Investments to bring the round total to $246M. [Insurtech Insights]

Employment verification software platform Truework is leveraging LLMs to execute automated task recommendations for net-new employers. [Truework]

JOKR, a platform for instant grocery delivery, secured $50M in Series D funding. [TechCrunch]

Indigo Raised $250M in funding to continue providing sustainability programs for farmers and agribusinesses. [TechCrunch]

Brezn: Steve Sarracino joined Alex Rinke, Co-CEO and Co-Founder of portfolio company Celonis on the main stage at Bits & Pretzels for a fireside chat on “Building a global technology giant out of Germany.” Huge thanks to our Berlin team Maximilian and Josh, for producing a

Secondaries aren’t a first: Steve sat down with Rosie Bradbury from Pitchbook to discuss crossover investors dipping their toes back into venture with pre-IPO secondaries.

Finovate NY: Our Partner Andrew Steele moderated a panel at Finovate New York on “The Future of Payments.”

Going global: Steve spoke on a panel at SuperReturn Asia in Singapore on “Expanding your Geographic Exposure: Opportunities in the US and in Europe.”

Activant is a research-focused global investment firm that partners with high-growth companies transforming the way the world makes, moves, and sells.

Founded in 2015, Activant has invested in category-defining companies like Deliverr (acq. by Shopify), Hybris (acq. by SAP), Bolt, Better, Celonis, Sardine, and many more.

The firm has $1.5B assets under management and is headquartered in Greenwich, Connecticut, with offices in New York City, Berlin, and Cape Town.

The Greene Street Observer is published monthly from Activant’s office on Greene Street in New York City.