- Activant's Greene Street Observer

- Posts

- Activant's Greene Street Observer No.11

Activant's Greene Street Observer No.11

Applying past lessons to 2024, and fresh research on 3rd Gen FP&A tools

Founders, Partners, and Friends,

It is generally sad when we bring a close to a year. We leave 2023 smarter and more durable, but the clock on our duration closes as well. Across the board we see so much risk in the system, but also so much opportunity. The setup of 2024 should bring us all optimism. The planes of competition are narrowing primarily around innovation, which, in the long run portends well. Let me explain in brief:

In eras long ago, wealth was largely established by domination and territorial expansion, such as Rome in the waning centuries of BC, Islam and its expansion conquering the West starting around 700 AD, and the British Empire in the 1600s. Not coincidentally, the East India Company was established in 1600. Some form of manifest destiny, which was referred to as the US’s westward expansion, was used in hundreds of more examples than mentioned above – all with the objective of territorial gain and wealth creation.

What should bring us all comfort, however, is the cost of this type of expansion today can bankrupt nations. Even an incursion, which is how the US has projected power for so long, has become extremely costly. This is no different than the high cost of belt and road type initiatives– slowly, the US and the world at large are waking up to this reality. Self-determination has the upper hand, and it is intellectually hard to argue with people of a land determining their own form of government and rules.

This brings me to two points, one fantastical and one practical. Like any organism, the human race needs growth. If we stop growing we will turn in on ourselves, which may be a bit of what we are seeing today. At this point, the last frontier of outward expansion is space. This is the next stage for humanity's manifest destiny. The nation states that win in the future will redirect a majority of their power or defense-related budgets to harvesting the resources and land beyond. I did say this will sound fantastical – and on a long enough timeline will be proved correct.

Given this historical perspective, the second takeaway is innovation is now the key driver of growth in any society. The AI boom has awakened the animal spirits in even old-line businesses and governments to innovate. This is why we are so optimistic about the future. As more and more resources are poured into cutting-edge technology, growth will follow.

When we talk about innovation, it isn’t a better software application to run simple tasks, but up-ending software development writ large. We are seeing this with AI. The incremental has become mundane, and as investors or managers of businesses, balancing long-term ambition and big goals with short-term practicalities is what separates great management.

It has been a long time since we have worried about “leap-frog” risk, meaning a company can be almost irrelevant overnight with the advent or application of cutting-edge technology. That risk is back, and this is good for all of us. We believe this will drive more venture and growth investments and corporate M&A out of fear of being left behind. Even with potentially higher rates for this decade, we believe we are at the very early stages of the next technology boom.

Our hope is that a thousand years from now, people will look back at our era as a turning point in humanity’s long story. In the practicalities of the short run, great managers with ambitious ideas that can execute in 2024 will continue to have access to capital, particularly ours.

Napoleon’s long vision (simplified) was to expand his empire throughout Europe. The practicalities were, according to Andrew Roberts, he fought 60 battles as the General and lost 7 of them. As Churchill said about elections, “winning matters.” In the end, Napoleon overextended or ran out of balance sheet. Ambitious goals require persistence and the willingness to fight some of the same battles over and over again. The lesson is to keep big and ambitious goals in mind and win 2024, one issue at a time.

Let’s go! 🚀

Steve Sarracino

Founder & Partner

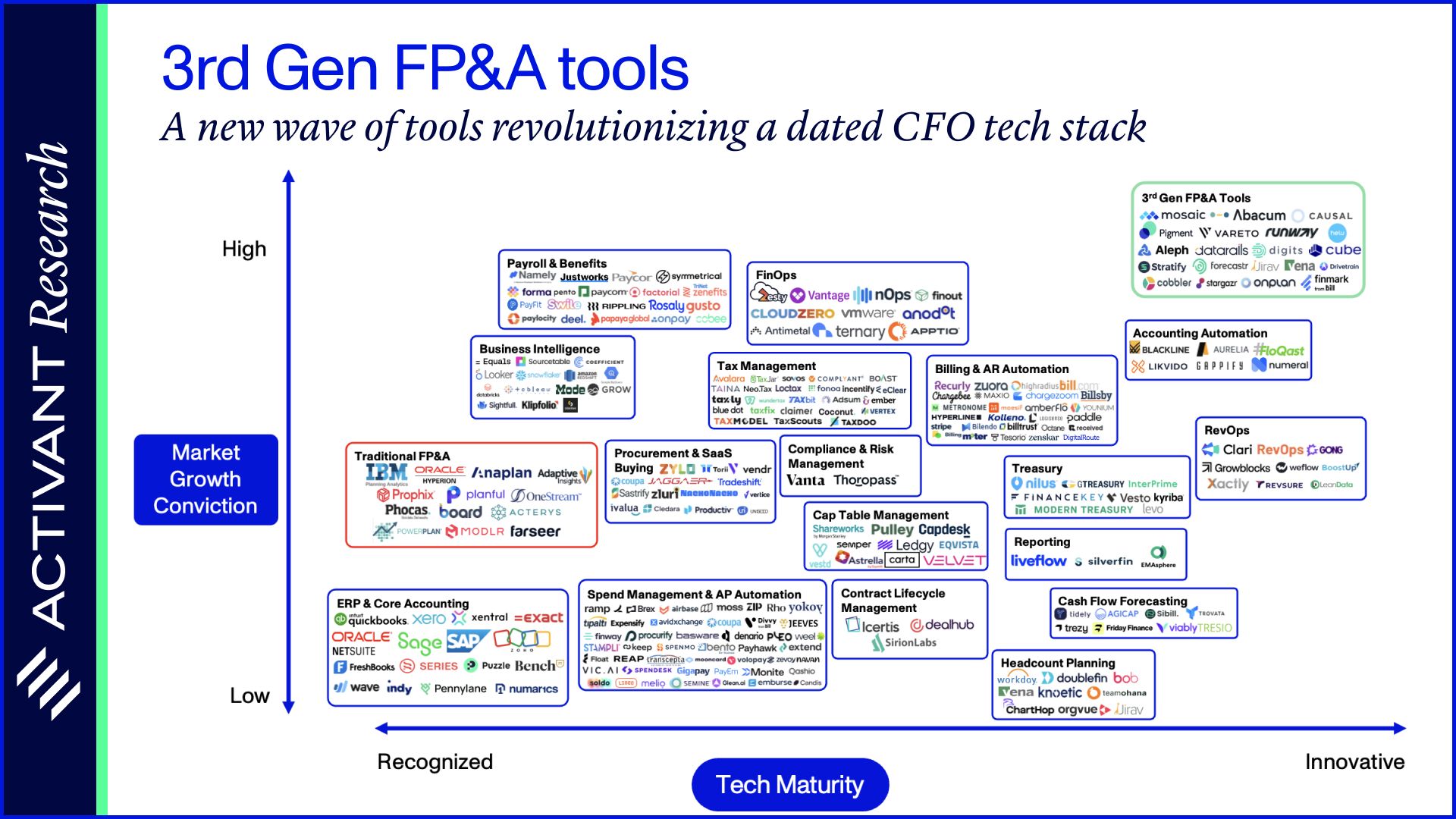

Today’s NPS scores for incumbent FP&A tools are -28, which is no surprise given that today’s tech stack for finance professionals is siloed, Excel-centric, and manual.

Our newest report on 3rd generation FP&A tools covers:

How and why the 1st and 2nd generation failed - and why the next generation is here to usher in the new wave of strategic finance

The mid-market opportunity - the sweet spot and most natural point of entry for 3rd generation tools

The three key vectors of success it takes to win in this market

Read the publication below to discover how we believe the next generation of challengers will tackle this multi-billion dollar opportunity.

We’ve received great feedback on the report from our readers so far. If you’re building in the 3rd Generation of FP&A tools, contact our authors Jono, Josh, Simphiwe, and Rob.

Andrew and Matilde from our investment team held a founder’s dinner in SF at Mr. Jiu’s in Chinatown. Thanks to everyone who attended!

Celonis announced that the state of Oklahoma will be using the company’s process mining software to ensure transparent and efficient oversight of the state’s budgeting and expenditure [Celonis]

Mobile-first omnichannel cloud platform for retail brands NewStore, was selected by Fossil Group to transform its shopping experience globally [PR Newswire]

Employment verification software Truework announced an income verification solution for tenant screening [PR Newswire]

Activant is a research-focused global investment firm that partners with high-growth companies, transforming the way the world makes, moves, and sells.

Founded in 2015, Activant has invested in category-defining companies like Deliverr (acq. by Shopify), Hybris (acq. by SAP), Bolt, Better, Celonis, Sardine, and many more.

The firm has $1.5B assets under management and is headquartered in Greenwich, Connecticut, with offices in New York City, Berlin, and Cape Town.

The Greene Street Observer is published monthly from Activant’s office on Greene Street in New York City.