- Activant's Greene Street Observer

- Posts

- Activant's Greene Street Observer No.7

Activant's Greene Street Observer No.7

Finding the Local and Overall Maximum of AI, plus fresh Activant Research

The Local and Overall Maximum of AI

Founders, Partners, and Friends,

In what has been a difficult private technology market, it is amazing how much enthusiasm and capital AI has injected into our system. Artificial intelligence or machine learning certainly isn’t new, but ChatGPT brought it to the mainstream or the public and investor consciousness. When an interesting technology becomes more mainstream (or a fad), we typically get a hype cycle that ends badly. We only need to look back a couple of years ago at crypto, before that big data, etc. For instance, I remember when nanotechnology was going to pull us out of the dot-com bust. Back then, there were entire funds built around nanotechnology.

Looking at the broader private market, seed and early-stage valuations are still up from 2021 levels, with later-stage valuations down 50%-80% in the same time period. I hear smart allocators say that you have to strip out AI investments and then early-stage valuations are down, but to do that, one would need to strip out every hype cycle over the years – of course valuations would look more reasonable.

Anyway, it is great to see enthusiasm again, deserved or not. The interesting thing about AI is that I think we have the same issue as before: owners of the data will have a massive lead – just like “big data.” Training models to train other models thus far is garbage. Unless the data is robust enough, and importantly there is a customer base or enough set of actions at the END of the decision to prove something was optimal, you can never know if AI produced the right outcome.

For instance, when Northrup Grumman in the 1980s was designing the B-2 Stealth Bomber, they looked at proportions between the fuselage and wings in order to maximize range. When they calculated the equation, they got a local maximum, but failed to calculate the second derivative to find the overall maximum. They built the entire program around a flawed design. When testing the plane’s range, the engineers and Northrop perceived the range as a maximum because they lacked feedback. This isn’t far from AI that lacks data and input finding local mins and maxes because there isn’t adequate data, and most solutions lack a solid feedback loop.

I think we can still safely say data is the modern oil, and not much has changed in that respect over the last few decades or longer. In the short run, this tips the advantage to nations that are willing to consolidate players where they can have superior data and scale advantages. China will have the lead here, and we can see the power of top-down decisions with the success of WeChat. Nothing like it exists anywhere else in the world. The AI solutions they will build will have a full view of data and outcomes and will give WeChat a huge head start.

In Galvin Menzies book 1421, he describes how a unified China sent hundreds of ships around the world. A well-resourced unifying mission accomplished feats well ahead of the city-states of Europe. In the long run, however, the second mover Europeans, driven by the hyper-competition between cities and states, caused the West to expand and hold that expansion (for better or worse). Fragmentation tends to bring many more and shorter feedback loops (discoveries) that could be built on by competing nations.

More companies competing with less resources and data will be much messier than what WeChat has at its disposal, but over time, should produce an equilibrium at the overall maximum rather than a local maximum. The current hype around AI will certainly produce long-term winners, but only on the shoulders of giants that came before, and likely the destruction of an immense amount of capital. Sounds like things are back to normal.

Let’s go! 🚀

Steve Sarracino

Founder & Partner

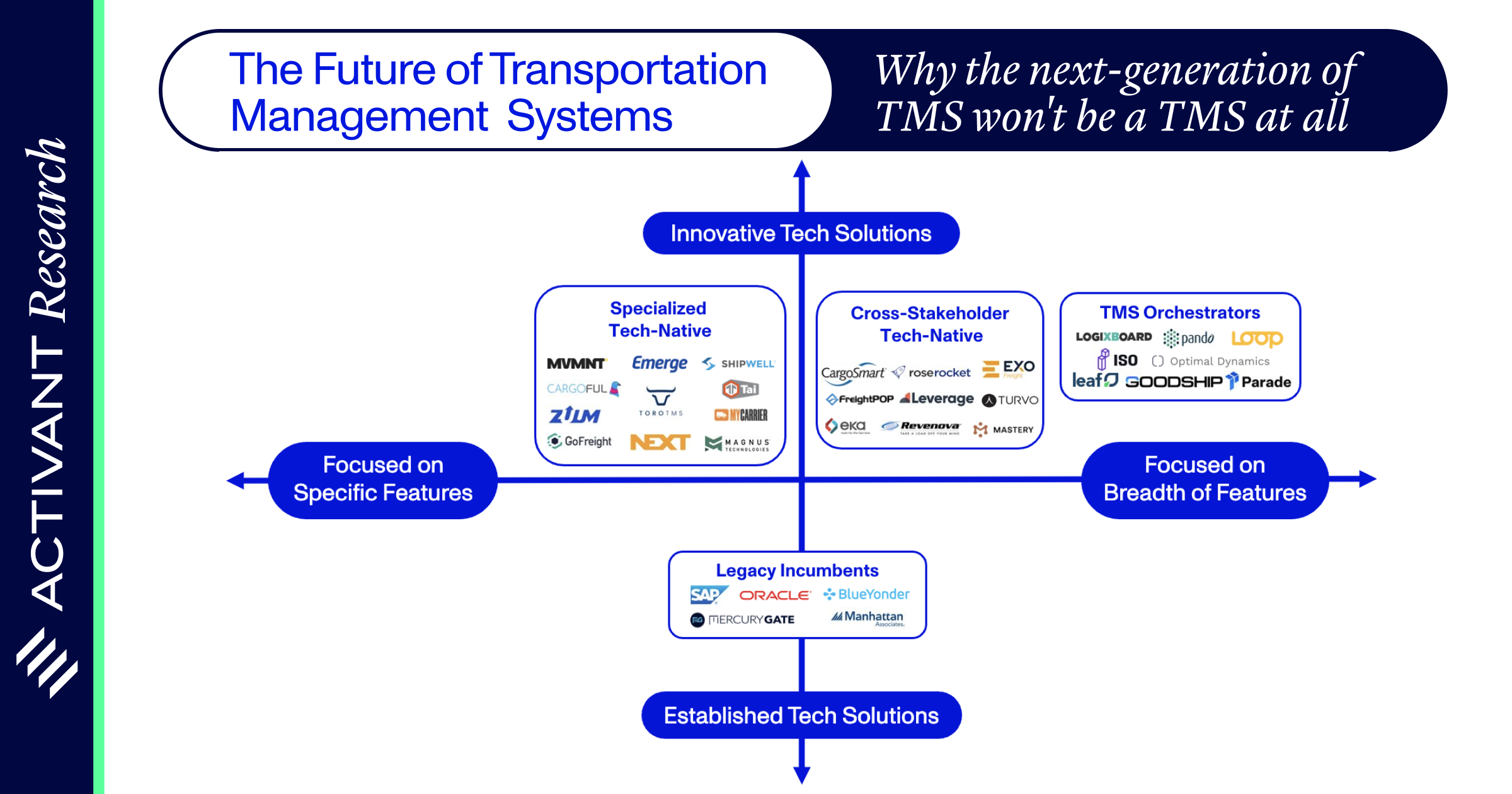

Our latest Activant Research report is a deep dive into the world of Transportation Management Systems - we think it’s one of the largest software categories you’ve never heard of:

A TMS is the mission-critical system of record used in logistics to track shipments and ensure everything we buy gets from point A to B.

It’s a fast-growing category (nearly 2/3rds of logistics pros use one today, vs 15% in 2005), and is projected to reach a $45B market size by 2030.

But the leading players are decades old, and all the experts and operators we’ve talked to are somewhere between mild dislike to outright loathing of their TMS.

And logistics needs modern software and automation to adapt to escalating disruption across supply chains.

We think it’s prime time for a new generation of TMS platforms, but we think what comes next won’t look like what the incumbents have today.

Read the full article below to find out how the next generation of challengers is tackling the opportunity:

We’ve received some great feedback on the article so far - if you’re interested in chatting about our findings, reply to this email or reach out to the report authors David and Julius.

We’ll be publishing more Activant Research going forward - keep an eye out for our next deep dive on the Future of Embedded Finance, which drops next week!

We hosted a dinner with founders and operators in Soho on July 13th, and another in San Francisco last Thursday, alongside our friends at Standard Metrics.

Simbe Robotics, a company revolutionizing grocery & retail with robotics & AI, raised $28M in Series B funding. [TechCrunch]

CEO and Founder of Newstore Stephan Schambach sat down with Forbes to talk about his novel process of combining e-commerce with personal retail. [Forbes]

Eco launched their new product Beam, which allows you to send money globally instantly. (LinkedIn)

New Faces: We’re excited to have Marc Wu join us on the investment team, and Simphiwe Msibi join us on the research team.

Giving back: Our team in Cape Town spent time preparing meals that were donated to the Haven Night Shelter in honor of Nelson Mandela Day.

Battle of the sandwiches: Our New York office hosted a PB&J-making competition, where teams competed to make the most innovative version of the simplest sandwich.

Activant is a research-focused global investment firm that partners with high-growth companies transforming the way the world makes, moves, and sells.

Founded in 2015, Activant has invested in category-defining companies like Deliverr (acq. by Shopify), Hybris (acq. by SAP), Bolt, Better, Celonis, Sardine, and many more.

The firm has $1.5B assets under management and is headquartered in Greenwich, Connecticut, with offices in New York City, Berlin, and Cape Town.

The Greene Street Observer is published monthly from Activant’s office on Greene Street in New York City.