- Activant's Greene Street Observer

- Posts

- A Five-Part Series: The Playbook for Winning in Market Consolidation

A Five-Part Series: The Playbook for Winning in Market Consolidation

Part II: Does the House Always Win? Inside the Tech Giants' AI “Gravity Wells”

Editor’s Note to the Reader:

Yesterday, we explored how the AI “gold rush” is giving way to a more selective market with capital concentrating into fewer, stronger companies and early signs of consolidation.

Big Tech used to sell the shovels. Now they want the gold. Microsoft, Google, Amazon, and Salesforce aren’t just offering AI tools – they’re building them into every layer of their platforms, drawing enterprise spend deeper into their ecosystems. For some companies, this creates new competitive dynamics. For others, these same platforms open powerful growth channels – through marketplaces, APIs, and partner programs that can help products scale faster than ever when they bring unique value that complements the platform.

The key question: Are you positioning to integrate deeply inside a tech giant’s ecosystem, or to compete from the outside with a differentiated, standalone platform? Part II of our series: Inside the tech giants’ AI “gravity wells” – and how founders can turn them into growth engines instead of competitive threats.

Part II: Does the House Always Win? Inside the Tech Giants' AI “Gravity Wells”

The consolidation of the AI market isn’t a random event; it is a calculated response by the technology giants to a clear demand signal from their most important customers. Microsoft, Google, Amazon, and Salesforce are no longer content to simply sell shovels in the AI gold rush. They want to claim the mines, building "gravity wells" designed to attract and retain enterprise spend.

For investors, understanding these platform “gravity wells” is critical, they can either accelerate a startup’s scale or quietly cap its upside.

The Driver: Enterprise “App Fatigue”

This shift is being driven by pervasive "app fatigue" among Chief Information Officers (CIOs), who are overwhelmed by vendor complexity and under pressure to deliver measurable returns on their technology investments. A PwC survey found that 82% of tech leaders say their companies are struggling to realize value from these investments.

As a result, enterprise leaders could be rationally choosing to consolidate. A Microsoft survey revealed that 86% of business leaders and employees point to a single, centralized platform as the ideal solution for collaboration and efficiency.

This sentiment is echoed in a Deloitte survey where 88% of leaders identified cloud as the foundation of their digital strategy, indicating a desire to build upon existing, trusted platforms. CIOs are rationally choosing to consolidate their spending with the major cloud providers, viewing their integrated AI offerings as a lower-risk path to achieving the productivity gains their organizations demand.

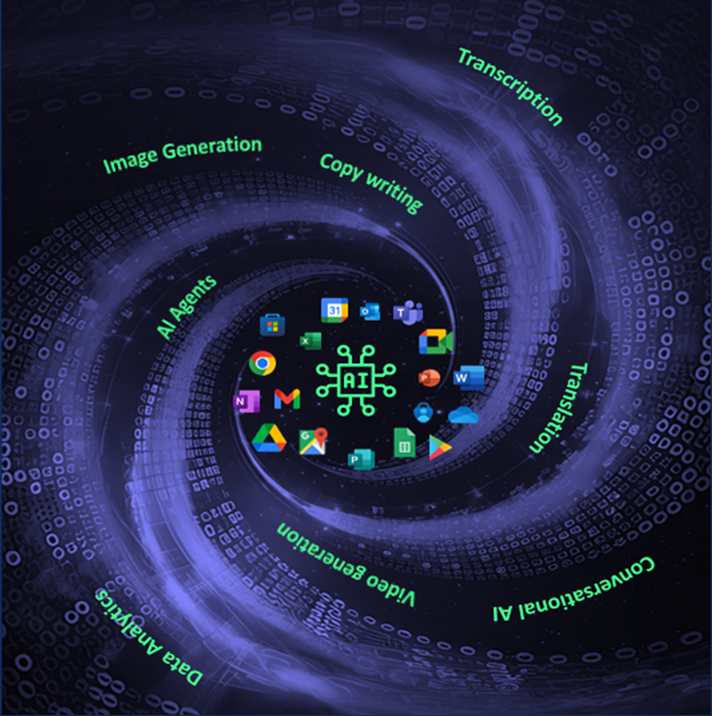

This is why the giants are pulling disparate AI functions – like translation, data analytics, and image generation, as metaphorically shown in the graphic above – into their core platforms.

The Strategic Advantage: Agentic AI on a Dominant Platform

The mechanism for this platform-led consolidation is the rise of "agentic AI"—systems capable of acting autonomously on behalf of users and business units. This is the new strategic battleground. Gartner projects that by 2028, AI agents will execute 15% of daily work decisions, up from virtually 0% in 2024. The tech giants are building the infrastructure to own this agentic layer, leveraging their existing dominance in cloud computing as a significant distribution advantage. In the second quarter of 2025, Amazon Web Services, Microsoft, and Google collectively controlled 67% of the global cloud market (excluding China). Their individual market shares in Q4 2024 stood at 33% for AWS, 20% for Microsoft Azure, and 11% for Google Cloud.

This existing infrastructure, combined with a vast customer base, enables the giants to deploy new AI capabilities to millions of users with a simple software update. They are weaving AI into the very fabric of enterprise work, transforming it from an application one opens into an ambient layer across the entire software ecosystem.

The Platform's Blind Spot: Winning on the Giants' Turf

While the gravity of the major tech giants is undeniable, it creates its own blind spot. These giants are optimized for building massive, horizontal solutions—a "one-size-fits-all" approach that often becomes "one-size-fits-none" for customers with deep, industry-specific needs. They are structurally too slow and too generalized to serve every niche effectively.

This is where the opportunity for startups emerges. The incumbents' platforms are not just fortified walls; they are also home to the largest marketplaces in software history, such as the Salesforce AppExchange and Microsoft Azure Marketplace.

For a specialized startup, these marketplaces represent a powerful distribution advantage. They offer:

Direct Access: A channel to a massive, aggregated pool of enterprise customers who are already qualified and have budget authority.

Reduced Friction: A trusted environment where discovery, procurement, and integration are streamlined, dramatically lowering a startup's customer acquisition cost (CAC).

Think of it like a race car drafting behind a large truck to conserve energy and gain speed. A savvy startup can "draft" behind an incumbent's massive go-to-market engine, using the marketplace to reach customers that would be impossible to acquire independently. The goal for some is not to compete with the tech giant’s platforms head-on, but to become an indispensable, value-adding component within its ecosystem.

Concluding Thought for Day 2: The Platform Paradox

For certain startups, one of the primary threats is no longer just another startup, it’s the "good enough" feature bundled for free into a core platform. However, this same dynamic creates a new opportunity. The platform's marketplaces have become valuable distribution channels in software.

The critical question for founders has evolved beyond "can you build a better product?" to "Can you build a moat so deep that even a platform update can’t erode it?” In this era, success requires a playbook for winning on the giants' turf, either by becoming a specialized, indispensable solution within their ecosystem or by building a stand-alone platform so deeply embedded in a customer's workflow that it creates its own gravitational pull.

For founders, the challenge is to decide: Are you building to integrate deeply within a giant’s ecosystem, or to compete from the outside with a differentiated, standalone platform?

Tomorrow: The Tech Giants “gravity wells” are reshaping the startup landscape in unexpected ways. We’ll break down the so-called “wrapper challenge” —why it could determine which AI products survive—and uncover the mechanics of the controversial “acqui-hire,” a strategy quietly redefining founder and investor outcomes.